Debt consolidation, a financial strategy adopted by many to manage mounting personal debts, is an industry awash with both praiseworthy organizations and controversial entities. In the heart of this dichotomy lies Bright Loan, a company that has attracted mixed sentiments from various quarters. The company claims to offer solutions for those grappling with multiple debts, but is there more beneath the surface? This article aims to critically review Bright Loan and its services, unearthing potential pitfalls and offering insights into the company’s operations.

Bright Loan’s reputation, as indicated by its ratings on Better Business Bureau (BBB) and Trustpilot, is far from stellar. With a less than perfect score, the company raises eyebrows, and one cannot help but approach it with a degree of skepticism. A plethora of negative reviews accompany the few positive ones, painting a picture of inconsistency at best, and at worst, a potential risk for anyone seeking the company’s services.

This critical review delves into the operations of Bright Loan, shedding light on its foundation, the services it offers, the risks associated with it, and how it compares to other industry players. In an industry plagued by controversy, this comprehensive review will help you make an informed decision and ensure you’re not another hapless victim of a cunning debt consolidation scheme.

Stay with us as we dissect Bright Loan, drawing from customer reviews, industry comparisons, documented case studies, and more. In a financial world that brings to mind the deceptive calm before a storm, much like in the hit movie “The Big Short,” it pays to tread cautiously. Every financial decision must be made deliberately, and with all the facts at hand. This review aims to provide those crucial facts, casting a spotlight on Bright Loan in all its glory and ignominy.

Bright Loan Company Background

Bright Loan entered the scene with a promise to transform the way people handle their debts. The company was founded under the conviction that individuals struggling with multiple debts needed a partner to help them navigate their journey towards financial freedom.

However, the road to financial freedom, as portrayed by Bright Loan, appears to be a rocky one for many customers. A myriad of testimonies and case studies reveal a more complex, and in many instances, a troubling experience. Customers have often raised concerns about the company’s integrity and practices, casting a shadow on the company’s brightly lit promise of debt freedom.

The company’s journey has not been devoid of achievements. Bright Loan has over the years managed to carve out a space for itself in the debt consolidation industry, establishing partnerships and alliances that have helped it increase its footprint. It has achieved key milestones, such as expanding its customer base and launching new products aimed at addressing customer needs.

However, these achievements are overshadowed by a number of customer complaints and disputes. Some customers claim that the company’s practices are misleading, and their promises only serve to lure unsuspecting victims into a more complex financial maze. Allegations of hidden fees, poor customer service, and even potentially illegal practices have been raised, further denting the company’s reputation.

In the world of debt consolidation and financial management, Bright Loan’s story brings to mind the movie “The Big Short“. In the movie, a group of investors bet against the US mortgage market, only to find that the market is fraught with fraudulent and predatory practices. Like the investors in “The Big Short“, customers of Bright Loan are often drawn in by attractive promises, only to find a reality that is far from what they were led to believe.

In conclusion, Bright Loan’s background reveals a company that has managed to achieve significant milestones, but one that is also embroiled in controversies and customer dissatisfaction. It is a company that, like many others in the debt consolidation industry, presents itself as a beacon of hope for those grappling with debt. However, the reality, as revealed by numerous testimonies and case studies, is one of inconsistency, unfulfilled promises, and potential risks.

Products/Services

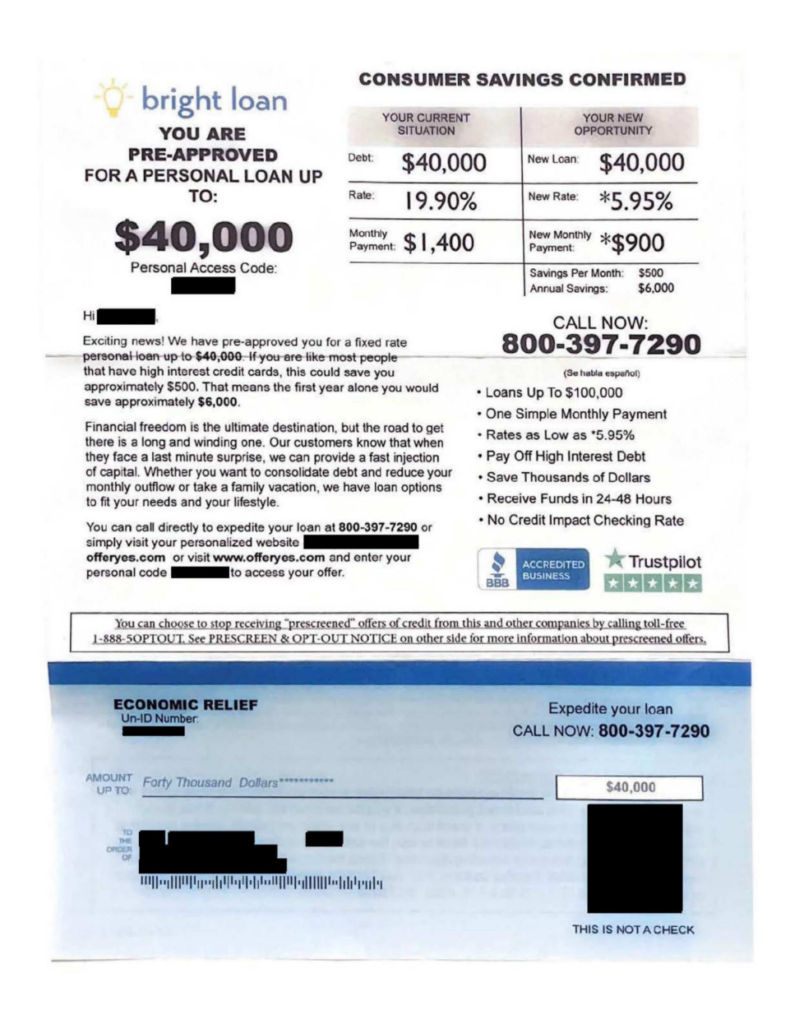

Bright Loan offers a variety of products and services, with debt consolidation being its primary offering. The company promises to help consumers manage their debt by consolidating multiple loans into a single payment with a lower interest rate. Nevertheless, a close look at these services raises questions about their effectiveness and overall value.

For one, the company has often been accused of being unclear about its rates and terms. Several customers have reported being caught off guard by hidden fees and high-interest rates that were not clearly stated during the application process. Such lack of transparency can trap consumers in an even more challenging financial situation than they were prior to consolidation.

Moreover, the company’s customer service has been a point of contention. While Bright Loan promises personalized service, numerous customer reviews suggest otherwise. Reports of unresponsive representatives and lack of timely communication are common, which raises serious concerns about the company’s commitment to its customers.

To put things in perspective, let’s conduct an interactive poll.

This quick poll can help gauge the general sentiment towards Bright Loan’s products and services. However, it’s important to supplement this with further research.

For instance, turning to trusted platforms like BBB and Trustpilot can provide further insights. On BBB, Bright Loan holds a less-than-stellar rating, with the majority of reviewers expressing dissatisfaction with the company’s services. Similarly, on Trustpilot, the company’s rating is average at best, with numerous customers citing issues with the company’s lack of transparency and poor customer service.

This critical look at Bright Loan’s offerings makes it clear that while the company promises to alleviate financial stress through debt consolidation, the reality might be far from this. The company’s lack of transparency, disappointing customer service, and the potential for hidden costs suggest that consumers should tread carefully when considering Bright Loan’s services. The company’s promises could very well be smoke and mirrors, leaving customers in an even tougher financial spot than before. Just as it’s crucial to read the fine print before signing any contract, it’s equally important to critically examine any company promising to help you manage your debt.

Risks and Controversies

Bright Loan, like many players in the debt consolidation industry, has been the subject of numerous complaints and controversies. Several risks and potential scams associated with the company warrant closer inspection by potential customers.

- Firstly, many customers have raised concerns about the company’s lack of transparency. Hidden fees, undisclosed terms, and lofty promises that fail to materialize have left many customers in a worse financial situation than they were before. This lack of transparency is not only deceitful, but it also poses a severe risk to customers who may find themselves trapped in a cycle of debt.

- Secondly, the company has been accused of employing aggressive and misleading sales tactics. Some customers report being pressured into signing up for services that they did not fully understand or need. This high-pressure sales approach not only violates the trust between the company and its customers but can also lead to severe financial repercussions for the latter.

- Bright Loan’s customer service is another area of contention. Numerous complaints suggest that the company is slow to respond to queries and complaints, further undermining the trust of its customers.

These controversies surrounding Bright Loan are alarmingly similar to some of the notorious scams in the financial industry. To help gauge reader opinion on these issues, consider taking this interactive survey:

These controversies underscore the importance of thoroughly vetting any company before signing up for their services, especially in the debt consolidation industry. Complaints and lawsuits against Bright Loan serve as a red flag for potential customers. So, tread carefully and conduct thorough research before entrusting your financial wellbeing to any organization.

Comparative Analysis

The comparative analysis clearly indicates that Bright Loan has significant areas for improvement when measured against industry standards and even against other companies with mixed reviews.

While this analysis might seem unfavorable for Bright Loan, it is intended to highlight the importance of thorough research before selecting a debt consolidation company. The aim is not to discourage but to prompt careful consideration and informed decision making when entrusting a company with your financial well-being.

In conclusion, while Bright Loan may promise an attractive debt consolidation solution, a comparative analysis with industry leaders and similar companies suggests that it might not be the best choice for everyone. This comparison underscores the need to consider various options and choose a company that is transparent, trustworthy, and aligned with your specific needs.

Conclusion

In this comprehensive review, we’ve critically examined Bright Loan from various angles, uncovering a multitude of concerns that potential customers should consider. From a lack of transparency to questionable customer service and aggressive sales tactics, Bright Loan has been linked to several controversies and risks that warrant serious consideration.

While Bright Loan may present an attractive solution for those struggling with multiple debts, the company’s practices and controversies suggest that customers should approach with caution. Always remember that when it comes to debt consolidation, it’s crucial to look beyond the enticing promises and conduct thorough research.

Before making any decisions, we encourage you to check out our detailed debt consolidation comparison chart, which provides an in-depth comparison of various industry players, including those discussed in this article.

To quote the famous movie character Gordon Gekko from “Wall Street,” “The most valuable commodity I know of is information.” In the realm of debt consolidation, this rings particularly true. So arm yourself with the right information, stay skeptical, and always do your homework.

In conclusion, while Bright Loan may promise a brighter financial future, it’s crucial to look beyond the surface and tread cautiously.

FAQs

1. What is Bright Loan? Bright Loan is an online platform that enables users to secure personal loans conveniently. They connect borrowers with a network of lenders who offer various loan options.

2. How can I trust Bright Loan with my personal information? While Bright Loan uses encryption technology and strict privacy policies to protect user data, it’s crucial to note that any online platform carries some risk. Always do ample research and ensure that any online financial transactions are done over secure networks.

3. What kind of interest rates can I expect from Bright Loan? Interest rates can vary greatly depending on factors such as your credit score, loan amount, and loan term. It’s important to thoroughly review the terms and conditions before accepting any loan offer.

4. How quickly can I receive funds from Bright Loan? While Bright Loan advertises quick loan processing times, actual disbursement may take longer due to various factors such as your bank’s policies or the time it takes to verify your information. Always plan for delays when considering this type of service.

5. Are there any upfront fees for using Bright Loan? Bright Loan does not charge upfront fees, but be aware that the lenders in their network may have different standards. Always review the terms of each lender before accepting a loan.

6. How does Bright Loan make money? Bright Loan is paid by the lenders in their network for connecting them with borrowers. This means that while Bright Loan does not directly charge you, the cost may be indirectly incorporated into your loan terms.

7. Does Bright Loan offer loans for people with bad credit? While Bright Loan does work with some lenders who offer installment loans to individuals with less than perfect credit, these Bright Lending loans often carry higher interest rates. Approach with caution and make sure the personal loan repayments are within your budget.

8. Does using Bright Loan guarantee a loan? No. Bright Loan only serves to connect you with potential lenders. The final decision on loan approval rests with the lenders themselves, and is dependent on things like your credit history and current financial situation.

9. Can I pay off my loan early with Bright Loan? While Bright Loan’s network of lenders may allow for early repayments, it’s essential to check with your individual lender as some may charge prepayment penalties. Always read the terms and conditions before signing any loan agreement.

10. How does Bright Loan compare to other online loan platforms? As with any service, Bright Loan has its pros and cons. While the platform may offer a convenient way to connect with potential lenders, it’s crucial to carefully review all terms and consider whether the loan fits within your financial plan. Always compare options from multiple sources before making a decision.