In the event that you find it difficult to pay off your debts, Crestridge Funding might be able to help. The company offers personal loans and debt consolidation loans, which may be able to assist you in achieving financial stability.

Crestridge Funding advertises its services at crestridgefunding.com, which is the company’s official website.

Review Summary

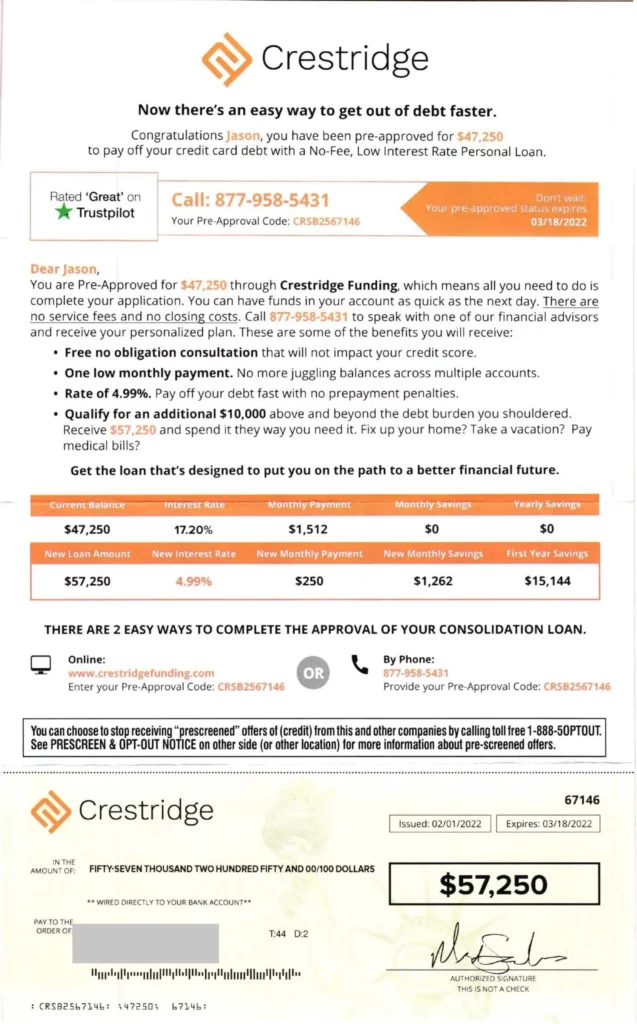

As a result of receiving a direct mail offer from Crestridge Funding, you may be wondering whether it’s worth considering if you are among the many Americans who have received one. If you have the option of taking advantage of their low-interest rate and large loan amounts, it can be tempting to take them up on their offer. However, before you do, it’s best to do your research and make sure you understand what you’re getting into. Therefore, we decided to look into this company to find out more about it.

The following facts were discovered when we took a closer look at their website and the mail offer they sent out.

- It is important to note that Crestridge Funding does not lend money directly to consumers. Instead, it has established relationships with a number of independent lenders who may be able to provide you with the credit you are looking for.

- In most states, the amount of money that you can borrow and the terms of the loan are determined by your credit history and the laws of the state in which you live. The minimum loan amount varies from one state to another.

- Approval for a loan may take longer if additional documentation is required. Terms of the loan will be determined based on your creditworthiness and state laws.

There was also some very valuable information that we were able to find.

- As a general rule, annual percentage rates (APRs) range from 2.92% (AAA) to 24.99% (AAAA).

- All residents of the state may not be able to take advantage of these products/services.

- In order to qualify for AAA Crestridge Funding, you must have excellent credit and meet other criteria.

- Any lender has the right to decline to extend your credit if you no longer meet the criteria after submitting your application. In this case, any lender has the right to decline to extend credit to you.

What Is Crestridge Funding?

It is through Crestridge Funding that they are able to help you connect with independent lenders who may be able to provide the credit you need. They do not lend money directly, but they work with a network of trusted lenders to help you obtain the financing you need.

The company’s name is Crestridge Funding, and they are not rated by the Better Business Bureau, but they are verified by Trustpilot and have a 4-star rating. They are located at 2300 Main Street, on the 9th floor, in Kansas City, Missouri, and their phone number is (877) 958-5431.

How Does Crestridge Funding Work?

It is important to remember that Crestridge Funding offers different Annual Percentage Rates (APRs) based on your credit score. In order to take advantage of their offer, you need to use your Personal Offer Code. This offer ranges from 2.92 percent for those with excellent credit to 24.99% for those with less-than-perfect credit. To qualify for the lowest rate, you will have to meet other conditions.

You should be aware that Crestridge Funding’s approval process is just one of many factors that may affect the APR you see on their offer. Your credit score, your monthly expenses, your identity, and your employment and income are just a few of the many factors that may affect the rate you receive.

It is important to keep in mind that once approved, the lender will be the originating lender and not Crestridge Funding. The APR you see on their offer is just an example – actual rates may be different depending on various factors such as your credit score.

As a first-time user, when you register with their website for the first time, you agree to have your information sent to several lenders for the purpose of obtaining a loan. To sign up on their site, you must agree to the following terms:

“I request that my information be provided to their partners, lenders, and financial services partners to provide me with financial recommendations, which may also include debt relief, credit repair, credit monitoring, or other related services. I agree to be contacted by Even Financial and/or Crestridge Funding its partners and their affiliated companies and financial institutions via email, postal mail service, and/or at the telephone number(s) I have provided above to explore various financial products and services I inquired about, including contact through automatic dialing systems, artificial or pre-recorded voice message, or text message.“

How Much Does Crestridge Funding Cost?

In addition to the company’s services, you may be charged fees by lenders for various products, and these fees will depend on the product and the location. These fees will be set by the lender and will be set at a different amount for different products.

Crestridge Funding Reviews

Despite the fact that Crestridge Funding is not registered with the Better Business Bureau, they are verified by Trustpilot and have received a four-star rating out of five.

Here are some reviews that have been submitted to Trustpilot:

Yaz Kensington 2/21/2022

Syahirah Solihin Feb 16, 2022

Alexina Fuentes Feb 12, 2022

Crestridge Funding FAQs

How Does Crestridge Funding Affect Your Credit?

The application process for a Crestridge Funding loan will include a review of your credit history. In most cases, this is known as a soft inquiry, and it usually won’t affect your credit score. It will be used to determine whether a person qualifies for a pre-approval for a credit offer. Soft inquiries are often used for determining whether someone qualifies for pre-approval.

What Should You Do If Crestridge Funding Asks For Your Personal Information?

If you provide Crestridge with your personal information, you are authorizing them to share that information with their partners, lenders, and other financial service providers. You may receive recommendations from these entities about debt relief, credit repair, or credit monitoring services that could potentially be beneficial to you.

How To Cancel Crestridge Funding

It is not possible to go back once you have taken out a loan. Once the money is in your account (or when you have a check in hand), you are committed to repaying the loan in accordance with the terms you agreed upon.

What Do You Need About Consolidating Your Credit Card Debt?

In the long run, consolidating your debt can be a great way to simplify your monthly payments and make it easier to pay off your debt, but there are a few things you should consider before taking out a debt consolidation loan.

The first thing to know about debt consolidation is that it doesn’t erase your debt completely. In addition, you may end up paying more interest on your debt with a debt consolidation loan than you would if you paid each of your debts separately. You will still owe the same amount, but it will be rolled into one monthly payment.

Therefore, before making a decision on whether or not to take out a debt consolidation loan, make sure that you weigh both the pros and cons carefully. If done correctly, consolidating your debt can help you save time and money, but if you do not do this carefully, it might end up costing you more in the long run.

Before Taking Out A Debt Consolidation Loan

1) You can find free credit counseling services at a nonprofit organization such as the Better Business Bureau if you are considering a consolidation loan. These organizations can provide you with guidance on managing your finances and paying off your debt, helping you avoid potential problems down the road in the future.

2) In order to get out of debt, you must get to the bottom of why you are in debt in the first place. You can’t get out of debt unless you understand why you are in debt. A debt consolidation loan may not be the best solution if you are able to reduce your spending or increase your income. Take a look at your budget to see if you can make any adjustments to it.

3) There are many different ways you can get out of debt, but the first step is making a budget. By analyzing your spending habits and making some adjustments, you will be able to get some breathing room, which in turn will allow you to pay off your debt. Make sure you follow these tips.

4) There is a possibility that your creditors will be willing to work with you if you are struggling to make your monthly credit card payments. You may be able to lower your minimum monthly payment, waive certain fees, or reduce your interest rate if you ask them for help. There may be creditors that will be willing to change the due date of your monthly payment so that it coincides better with the month in which you are paid, allowing you to pay off your debt quicker.

Is Crestridge Funding Legit?

There has been a thorough investigation done, and we have been able to establish that Crestridge Funding is legitimate. They do not engage in lending themselves, but they do have working relationships with a network of independent lenders that may be able to provide you with credit.

However, despite the fact that they are not accredited by the Better Business Bureau, they do have a high rating on Trustpilot.

This company is a great resource if you would like to compare lenders’ rates and see what’s available. However, you should do your own research before using this service, and read as many reviews as you can to arrive at the most accurate conclusion.

Thanks for reading!