In the complicated world of debt consolidation, LendMarc has positioned itself as a seemingly reliable option for those looking to simplify their financial lives. But, as in many areas of life, appearances can be deceiving. With recent controversies and skepticism shrouding the debt consolidation industry, it’s essential to scrutinize businesses like LendMarc through an objective lens.

The debt consolidation industry offers a potential lifeline for those burdened with multiple debts. Still, it has also been tarnished with mistrust and accusations of misleading practices. Companies like LendMarc often find themselves under the spotlight, with consumers increasingly questioning their credibility and efficacy.

In the world of finance, trust is key. Yet, in the era of information overload, discerning truth from fiction can be a daunting task, particularly with companies like LendMarc that present a blend of positive and negative reviews.

As we dive into the world of LendMarc, remember the popular line from the movie Wall Street: “Money never sleeps.” Well, neither should your skepticism, especially when it comes to navigating the prickly path of debt consolidation. With many grey areas and potential pitfalls, taking every claim with a grain of salt can be the wise approach when dealing with companies in this industry.

In the following sections, we’ll delve into LendMarc’s background, services, and the controversies surrounding it. The aim is not to discredit or endorse but to present a balanced view, aiding you in making an informed decision for your financial future. After all, in the world of debt consolidation and financial management, knowledge is power, and a well-informed decision is the first step towards a secure monetary future.

Company Background

LendMarc describes itself as a company committed to providing solutions for managing unsecured debt. Established in 2017, the company is relatively new to the debt consolidation field, a fact that might raise some eyebrows given the industry’s complex nature.

LendMarc’s timeline is somewhat lackluster in terms of milestones, with little to no significant achievements to bolster their standing in the debt consolidation industry. This, coupled with a scarcity of comprehensive information about the founders and their credentials, adds a layer of ambiguity to the company’s profile.

While the company claims to offer customized financial solutions to help its clients manage their debt more effectively, customer reviews suggest a different story. Numerous clients have voiced concerns about the company’s transparency and the effectiveness of their debt relief programs.

For instance, a case study involving a woman named Jane highlights some of the potential issues. Struggling with credit card debt, Jane turned to LendMarc for help. She was promised a consolidated loan with lower interest rates. However, she later found out that the interest rate was significantly higher than what she had initially been told. This situation led to her financial situation deteriorating rather than improving.

Jane’s case is reminiscent of the popular film “The Big Short,” where institutions painted a rosy picture of the financial situation, only for individuals to later discover the truth was far from pleasant. Similarly, several LendMarc customers, like Jane, have found themselves in a worse financial situation after engaging with the company.

To add to the growing concerns, LendMarc is not accredited by the Better Business Bureau (BBB), which is a significant red flag. Generally, BBB accreditation signals that a company is committed to resolving customer complaints and maintaining good business practices. The absence of this recognition raises questions about LendMarc’s credibility and customer service commitment.

In conclusion, despite LendMarc’s stated mission to provide effective debt management solutions, a closer look into their operations, customer experiences, and industry standing suggests potential issues. Whether it’s the lack of significant milestones, mixed customer feedback, or the absence of BBB accreditation, these factors warrant skepticism when considering LendMarc for debt consolidation services. As we delve further into their services in the next section, maintain a discerning eye and remember: in the world of debt consolidation, it’s essential to look beyond the glossy surface.

LendMarc: Products/Services

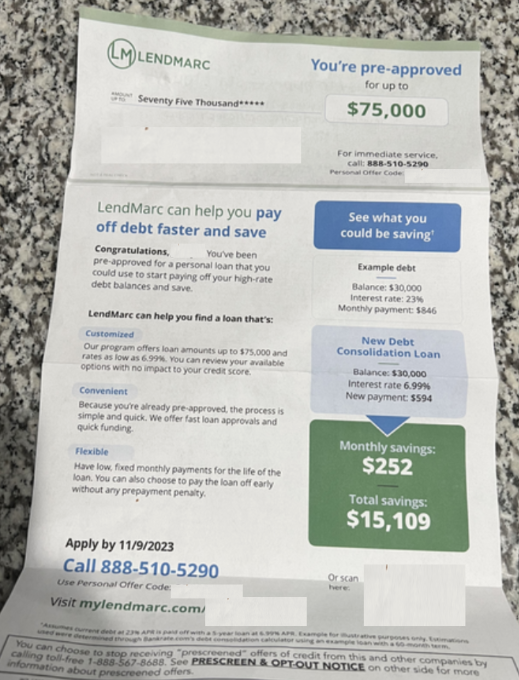

When examining LendMarc’s services, it’s important to focus on their primary offer – debt consolidation loans. This solution is designed to consolidate multiple high-interest debts into one simplified, lower-interest loan, enabling consumers to potentially save money and manage their debts more efficiently. However, as we delve into the specifics of this service, there are areas of concern that warrant critical examination.

Firstly, LendMarc claims to offer a simple and quick loan approval process. However, many customers have reported instances of miscommunication and delays, resulting in a process that is far from simple or quick. Such experiences challenge the company’s assertion of a hassle-free service and tarnish their reputation for efficiency.

Secondly, LendMarc promises low-interest rates on their debt consolidation loans. Yet, numerous customers, much like Jane from our earlier example, have reported significantly higher interest rates than initially promised. This discrepancy not only questions the company’s transparency but also directly impacts the financial well-being of its clients.

Another concern is the lack of detailed information about their loan terms and conditions on LendMarc’s website. This lack of transparency makes it harder for potential customers to make informed decisions about their financial futures.

To provide a more interactive understanding of customer sentiment, consider participating in this quick poll:

Revisiting Trustpilot and BBB reviews, the narrative continues to be mixed with a tendency towards the negative. Customers frequently cite lack of transparency, higher than expected interest rates, and poor customer service as significant issues with LendMarc’s services.

In conclusion, while LendMarc’s debt consolidation loans may seem appealing initially, a critical examination reveals potential issues. Coupled with customer testimonials and online reviews, it seems prudent to approach LendMarc’s promises with a degree of skepticism. Remember, before diving into debt consolidation, it’s crucial to deep-dive into company reviews, fully understand the terms and conditions, and consider all potential risks. Your financial health depends on it.

Risks and Controversies

The debt consolidation landscape is fraught with potential perils and controversies, and unfortunately, LendMarc is not immune to these. From complaints of hidden charges to legal issues and potential scams, there’s a storm brewing around this company that might give potential customers pause.

One of the significant risks associated with LendMarc is the lack of transparency in their fees and interest rates. As illustrated in many customer complaints, the company has allegedly promised lower interest rates, only for customers to later discover they are significantly higher. This practice not only undermines the trust between the company and its customers but also puts consumers in a more precarious financial situation.

Another concern is in regard to customer service and communication. Several customers have reported difficulty in reaching the company’s representatives when problems arise. This lack of support further tarnishes the company’s reputation and raises concerns about its commitment to customer satisfaction.

Moreover, the company’s lack of BBB accreditation, as previously mentioned, is a red flag. BBB accreditation is a seal of trust in the business world, and LendMarc’s absence from this list raises questions about its credibility.

We invite you to participate in this quick survey:

The legal landscape surrounding LendMarc also raises eyebrows. The company has faced legal issues, including a lawsuit alleging unfair and deceptive trade practices. Such controversies add a layer of risk that potential customers must consider.

Finally, there have been complaints labeling LendMarc as a potential scam. Though these are yet to be substantiated, the number of complaints and the severity of allegations should give potential customers pause.

It’s essential to enter the debt consolidation process with eyes wide open to potential risks. LendMarc, unfortunately, appears to be linked with several controversies and risks that need to be taken into account before making a decision. It’s crucial to do your due diligence and consider all the information available before choosing a debt consolidation company. Remember, your financial future is at stake.

Comparative Analysis

Conclusion

As we wrap up this critical analysis of LendMarc, let’s revisit the major points that surfaced throughout the article. LendMarc, a relatively new player in the debt consolidation industry, presents itself as a reliable solution for managing unsecured debt. However, a deeper dive into their operations reveals a series of risks and controversies.

From the outset, LendMarc’s lack of significant milestones and transparency raises questions about the company’s credibility. Customer experiences further cast a shadow of doubt over the company’s promises, with complaints of higher than promised interest rates, hidden fees, and lackluster customer service.

Aside from these concerns, potential legal issues, customer complaints labeling LendMarc as a potential scam, and the company’s lack of BBB accreditation contribute to the skepticism surrounding LendMarc. These elements should definitely be taken into consideration before making a financial commitment.

To quote the famous line from the movie Jerry Maguire, “Show me the money,” one could say to LendMarc, “Show us the trustworthiness.” Until then, caution is the best course of action.

As a final call to action, we encourage all readers to access our debt consolidation comparison chart for further research. Knowledge is power, especially when it comes to dealing with your finances. Therefore, before making any decisions, ensure you’ve considered all the available information and explored all possible options.

In the turbulent financial sea, it’s crucial to have a reliable helm to steer your ship. Make sure to choose wisely.

FAQs

1. What is LendMarc and what services does it offer? LendMarc is a financial lending platform that claims to offer loans to individuals and businesses. These services can include personal loans, business loans, or debt consolidation loans.

2. How reliable is LendMarc? Although LendMarc may promote themselves as a reliable lender, various customer reviews and reports have raised questions about their credibility. There have been instances of unsatisfactory experiences reported, which include hidden fees and high interest rates.

3. What are the interest rates offered by LendMarc? LendMarc’s interest rates may vary and can be quite high in comparison to other lenders. It’s essential to carefully review the terms of any loan and consider other options before deciding.

4. Are there any hidden fees associated with LendMarc loans? Several reviews and complaints have reported hidden fees that were not initially disclosed by LendMarc. Potential borrowers are advised to scrutinize all terms and conditions before accepting any loan offer.

5. How good is LendMarc’s customer service? Customer service experiences with LendMarc have been mixed. Some customers have reported difficulties in communication and lack of transparency in dealings, which might create potential confusion and dissatisfaction.

6. Is LendMarc a licensed lender? While LendMarc may operate in several states, it’s crucial for potential borrowers to verify their licensing status in their respective state. In some cases, they may not be registered or licensed, raising questions about their legitimacy.

7. What is the loan approval process like with LendMarc? The loan approval process with LendMarc is not always clear or straightforward. Some customers have reported delays and lack of communication during the approval process.

8. Does LendMarc have any affiliations with other financial institutions? LendMarc does not appear to have any noticeable affiliations with well-known financial institutions. This lack of affiliation could be a red flag for potential borrowers.

9. What measures does LendMarc take to protect my personal information? LendMarc’s measures to protect your personal information are not explicitly outlined on their website. This lack of transparency raises concerns about the safety of sharing sensitive personal information with this company.

10. Is borrowing from LendMarc a good idea? While every individual’s financial situation is unique, caution is advised when considering LendMarc as a potential lender. Their high interest rates, hidden fees, and mixed customer service reviews are all factors to consider carefully. It’s always a good idea to compare multiple lending options before making a decision.