The debt consolidation industry is rife with controversies in recent times. Companies like Liberty First Lending have been in the vortex of these controversies. They appear as saviors to those on the brink of financial ruin, promising to help consolidate and manage their debt. But, a closer look often reveals a much murkier picture. The Better Business Bureau (BBB) and Trustpilot, two well-respected customer review platforms, reveal a mixed bag of reviews that warrant careful consideration. There is an emerging skepticism about this industry, reminiscent of the subprime mortgage crisis depicted in the film “The Big Short.” Let’s pull back the curtain and take a closer look at the operations and credibility of Liberty First Lending.

Liberty First Lending is a financial services company that offers debt consolidation solutions to its clients. The company prides itself on its ability to provide customized plans aimed at reducing monthly payments and overall debt. However, a critical review of the company paints a more complicated picture.

The company has had its fair share of negative reviews and complaints. Some customers claim to have been misled by the company’s promises and have ended up in an even more precarious financial situation. These testimonials echo the sentiments of Mark Baum from “The Big Short,” who discovered the ugly truth behind what seemed like a profitable venture.

Furthermore, the company’s standing with the Better Business Bureau (BBB) and Trustpilot raises more questions than answers. With an average rating, the company’s services have been met with mixed reviews from clients. Some praise the company for its helpful service, while others accuse it of deception and poor customer service. This disparity warrants a more in-depth look into the company’s operations, products, and services.

In the following sections, we will delve deeper into these aspects and shine a light on the pros and cons of associating with Liberty First Lending. We will also explore the company’s reputation and controversies, all aimed at providing you with a comprehensive review. Like the classic poker film “Rounders” advises, “You can’t lose what you don’t put in the middle. But you can’t win much either”. In this case, it’s your financial well-being in the middle, and you can’t afford to gamble it away.

Company Background

Liberty First Lending, a debt consolidation company, began its operations with the mission to help consumers navigate their financial woes. Since its inception, the company has been offering its services to individuals struggling with high-interest debt, offering them solutions to manage their debts more effectively and potentially save them from financial turmoil.

However, the company’s journey has not been smooth sailing, with several roadblocks along the way. Liberty First Lending has faced intense scrutiny and skepticism over the years, primarily due to the controversies that continue to shroud the debt consolidation industry. Critics claim that the company’s promises often don’t match up with what’s delivered, leaving customers in a more precarious financial situation than before. This has led to a wave of complaints and negative reviews on platforms such as the Better Business Bureau (BBB) and Trustpilot, casting doubt on the company’s practices.

In fact, some customers have likened their experience with Liberty First Lending as a real-life version of the movie ‘The Money Pit,’ where what initially appeared as a good investment quickly spiraled into an endless cycle of complications and expenses. These testimonials, coupled with the company’s mixed reviews, raise significant doubts about the company’s credibility and effectiveness.

Despite these controversies and criticisms, Liberty First Lending continues to operate, offering its services to new clients. While it does have a clientele that vouch for its services, the number of disgruntled customers and their experiences cannot be ignored.

In the debt consolidation industry, a company’s reputation is paramount, and with a track record like Liberty First Lending’s, one must proceed with caution. While they claim to provide relief from crushing debt, their history suggests that the reality could be far from the promise. As we dig deeper into this company’s operations, services, and customer feedback, it’s essential to remember the phrase from the classic movie ‘The Godfather’: “It’s not personal, it’s strictly business.” The business of managing your debt, in this case, is too crucial to leave in the hands of a company with questionable practices.

Products/Services

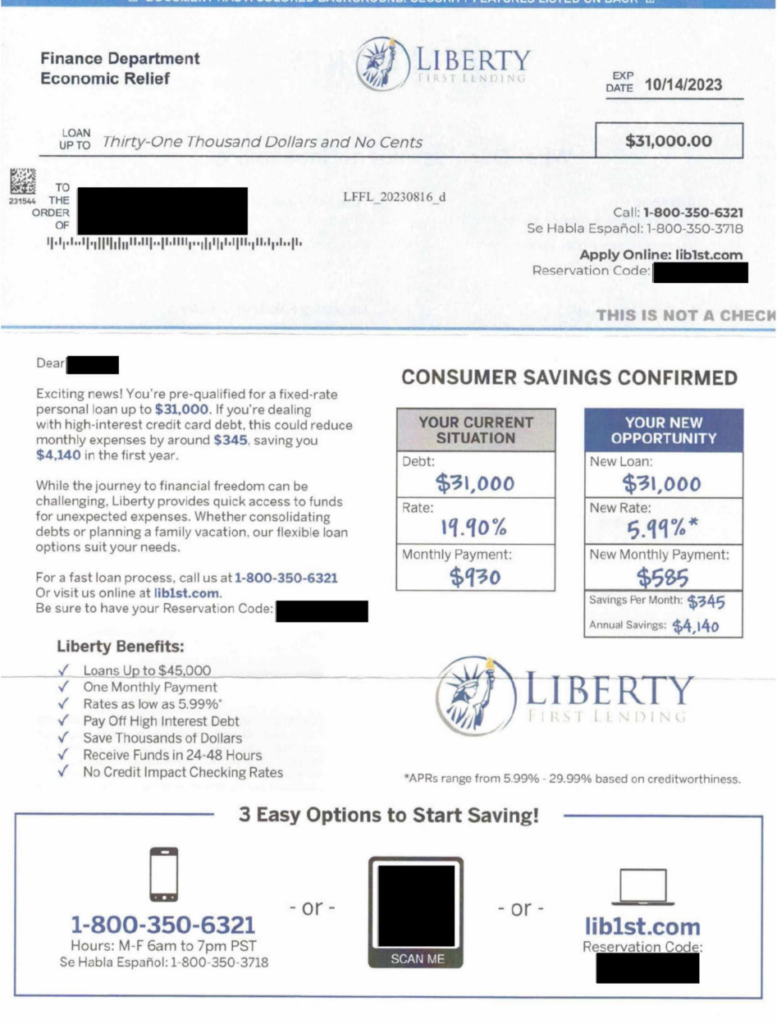

Liberty First Lending offers a range of financial solutions, with their main product being debt consolidation services. They claim to provide a lifeline to individuals struggling under the crushing weight of multiple high-interest debts by offering lower interest rates and streamlined monthly payments. As attractive as it sounds, a meticulous review of their services reveals some alarming aspects.

Firstly, the company’s debt consolidation process is not very clear. While they promise to reduce debt by negotiating with creditors, the details of how this is done are not transparent. This lack of clarity raises eyebrows considering the complex nature and high stakes involved in debt consolidation. It’s like playing a game of Jumanji, where every roll of the dice could lead to unforeseen consequences.

Customer reviews on BBB and Trustpilot indicate that the company’s services might not live up to their grand promises. While some clients have reported a smoother debt management journey with Liberty First Lending, many others have expressed discontent, asserting that the company’s services did nothing to alleviate their financial burdens, and in some cases, even exacerbated their debt problems.

Moreover, the company’s communication, support, and follow-up services leave much to be desired. Several customers have complained about being left in the dark after signing up for their services, with no regular updates or insights into how their debt is being managed. This is as disconcerting as walking into the haunting Overlook Hotel in ‘The Shining’ with no sense of what lies ahead.

In a world where transparency is becoming increasingly important, the ambiguity surrounding Liberty First Lending’s debt consolidation services is disconcerting. While the company may have helped some customers manage their debts more effectively, the mounting concerns and complaints suggest that their services may not be as effective or reliable as they claim. As always, it’s crucial for consumers to scrutinize such services and make informed financial decisions. Just like in the movie ‘The Matrix,’ sometimes, taking the red pill and facing the harsh reality is better than living in blissful ignorance.

Liberty First Lending: Risks and Controversies

No company operating in the financial services sector is immune to controversies and risks, and Liberty First Lending is no exception. The company has its fair share of complaints, lawsuits, and negative reviews, painting a picture of a business that may not be as reliable or effective as it claims to be.

The primary risk associated with Liberty First Lending is the company’s opaque modus operandi. Customers have reported a lack of clarity and transparency in how their debts are managed. This lack of transparency can lead to unforeseen consequences, such as higher than expected fees, miscommunication, and worsening financial conditions. It’s akin to navigating through the maze in ‘The Shining,’ filled with unexpected turns and dead ends.

Beyond these operational risks, the company has also been embroiled in legal controversies. Several lawsuits have been filed against Liberty First Lending, primarily by dissatisfied customers who feel misled or cheated by the company’s services. While legal disputes are not uncommon in the financial services sector, the number and nature of these lawsuits are a cause for concern.

Customer reviews on BBB and Trustpilot reveal a multitude of complaints against Liberty First Lending. Customers have reported issues ranging from poor customer service to failure in delivering promised results. Some customers even assert that their financial situation worsened after availing the company’s services.

In conclusion, Liberty First Lending’s operations are marred by multiple risks and controversies that potential customers need to be aware of. The company’s lack of transparency, coupled with its legal disputes and negative customer reviews, make it a risky choice for individuals seeking debt consolidation services. As Morpheus says in ‘The Matrix,’ “I’m trying to free your mind, Neo. But I can only show you the door. You’re the one that has to walk through it.” So, before you decide to walk through the door of Liberty First Lending, make sure you are well-informed about the potential risks and controversies you might encounter.

Pros and Cons

As with any company, Liberty First Lending has its pros and cons. Gaining insights into these can help potential customers make informed decisions about whether this company can truly assist in their financial journeys.

Pros:

- Customized Debt Solutions: Liberty First Lending purports to tailor its services to the unique needs of each customer. This personalized approach could potentially help individuals find the most suitable path out of their debt predicament.

- Range of Services: Beyond debt consolidation, the company offers a variety of financial services. This range can provide customers with multiple avenues for managing their finances.

Cons:

- Lack of Transparency: Perhaps the most glaring issue with Liberty First Lending is its lack of transparency. Several customers have reported confusion and frustration due to the company’s opaque processes and communication.

- Negative Customer Reviews: The slew of negative reviews on BBB and Trustpilot raises red flags about the effectiveness of Liberty First Lending’s services. Customers have complained about everything from poor customer service to ineffective debt solutions.

- Legal Controversies: The company has faced several lawsuits from disgruntled customers, further tarnishing its credibility and reliability.

In conclusion, while Liberty First Lending may offer customized solutions and a range of services, the company’s lack of transparency, negative customer reviews, and legal issues significantly hamper its appeal. It’s reminiscent of the movie ‘The Good, The Bad, and The Ugly,’ with Liberty First Lending embodying all three aspects in its operations. Potential customers should tread carefully, balancing the potential benefits against the considerable downsides, and as always, do thorough research before making any financial commitments.

Conclusion

In the debt-stricken landscape of America, companies like Liberty First Lending are a dime a dozen, each promising to be the silver bullet to your financial woes. While some of these companies might indeed provide viable solutions, our review reveals that Liberty First Lending has notable shortcomings that potential customers should be aware of.

Throughout this article, we’ve explored the company’s background, its products and services, as well as the risks and controversies surrounding it. A common thread in all these sections is the contradiction between Liberty First Lending’s promises and the reality experienced by several of its customers. Despite providing a range of financial services and claiming to offer tailored solutions, the company’s lack of transparency, mixed customer reviews, and legal controversies raise significant concerns.

As we’ve seen through customer testimonials and reviews on BBB and Trustpilot, the company’s debt consolidation service, which should ideally reduce financial strain, has sometimes led to increased stress due to lack of clarity and ineffective results. This, combined with poor customer service, makes for an overall negative experience for many of their customers.

To sum it up, the undercurrents of uncertainty and dissatisfaction surrounding Liberty First Lending make it difficult to recommend their services outright. Much like stepping into the maze in ‘Inception’, you may find yourself in deeper than expected with no clear path out. We strongly advise potential customers to do their due diligence, consider the experiences of other customers, and use resources such as our debt consolidation comparison chart before making a choice.

As the saying goes, “Forewarned is forearmed”. The purpose of this review is not to cast a villainous shadow over Liberty First Lending, but to ensure you are well-informed about the potential risks. After all, as the iconic film ‘The Usual Suspects’ teaches us, “The greatest trick the devil ever pulled was convincing the world he didn’t exist.” In the realm of debt consolidation, it’s crucial to see past the smoke and mirrors to the reality beneath.

FAQs

- What is Liberty First Lending and what services do they offer? Liberty First Lending is a financial services company, specifically a mortgage lender specializing in helping homeowners refinance their current mortgage. However, as with any financial services company, it’s important for potential customers to carefully review and understand the terms of their services.

- How experienced is the staff at Liberty First Lending? Liberty First Lending claims to have a team of highly experienced and knowledgeable professionals. However, the actual level of experience and expertise can differ among staff members. It is advisable for potential customers to evaluate the credentials of the professionals handling their financial affairs.

- Does Liberty First Lending have any certifications or awards? Liberty First Lending lists several awards and certifications on its website. Nevertheless, industry recognition and awards are not always a reliable indicator of the quality of service or future performance.

- What types of clients does Liberty First Lending serve? Liberty First Lending primarily serves homeowners looking to refinance their mortgages. However, details about their client base and their success with those clients are not readily available.

- What is Liberty First Lending’s approach to mortgage lending? Liberty First Lending claims to offer personalized services based on each client’s specific financial situation. But it’s wise to thoroughly scrutinize this claim and compare their offerings with other lenders to ensure you’re getting the best possible deal.

- Does Liberty First Lending have any past or pending legal issues? Information regarding legal issues involving Liberty First Lending is not readily available. It is always prudent to conduct a comprehensive background check before engaging with any company, including Liberty First Lending.

- What fees does Liberty First Lending charge for its services? Liberty First Lending does not provide a clear and detailed fee structure on their website. It’s advisable for potential clients to seek clarity on all fees before entering into a contract.

- How does Liberty First Lending safeguard customer data? While Liberty First Lending claims to have robust data protection policies, they do not provide clear details on these measures. Clients should inquire about these policies to ensure their personal and financial information will be adequately protected.

- How transparent is Liberty First Lending about their operations? Liberty First Lending provides certain information about their services and operations, but they do not offer a comprehensive view of their business practices. It is recommended to ask for detailed explanations of any unclear aspects of their operation.

- How does Liberty First Lending compare to other mortgage lenders? Liberty First Lending is just one of numerous mortgage lenders in the market. Their offerings, while notable, are not unique in the industry. Potential clients are advised to compare Liberty First Lending’s services, fees, and customer service records with those of other firms to ensure they’re making the most informed choice possible.